Economic Survey sees Rupee under stress

New Delhi, Jan 31 (UNI): Noting that Indian Rupee (INR) has performed better than most currencies, Economic Survey 2022-23 has said that the challenge of the depreciating rupee persists amid chances of further increase in policy rates by the US Federal Reserve (US Fed).

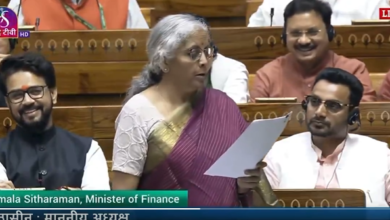

The key economic document tabled in Parliament on Tuesday by Finance Minister Nirmala Sitharaman further said that widening of the current account deficit (CAD) may also continue as global commodity prices remain elevated and the growth momentum of the Indian economy remains strong.

“The loss of export stimulus is further possible as the slowing world growth and trade shrinks the global market size in the second half of the current year,” the Survey said.

Meanwhile, the Indian rupee fell as much as 52 paise to 82.04 against the US dollar in intra-day trade on Tuesday.

The Survey said that with monetary tightening, the US dollar has appreciated against several currencies including the rupee but the Indian currency has been one of the better-performing currencies worldwide. It noted that the modest depreciation rupee underwent may have added to the domestic inflationary pressures besides widening the CAD.

“Global commodity prices may have eased but are still higher compared to pre-conflict levels. They have further widened the CAD, already enlarged by India’s growth momentum. For FY23, India has sufficient forex reserves to finance the CAD and intervene in the forex market to manage volatility in the Indian rupee,” the Survey pointed out.

The Economic Survey said that the slowing global demand will likely push down global commodity prices and improve India’s CAD in FY24.